Property market update as the financial year wraps up.

Yep, at Bowerbird Interiors, we design and style properties, it’s imperative that we keep a close eye on the real estate market, so we can plan for the future and make concerted assumptions on the current state of play with our own revenue outcomes. Having an understanding of what’s happening in our market also helps us to support our agents better.

So, here is what we know, and let’s face it, this year has been a rollercoaster for the economy, with interest rate hikes, high inflation, and wage decisions that could lead to a wage-price spiral. Despite all this, Australia’s housing markets are still moving forward. According to CoreLogic monthly value index, our combined capital cities have increased in value by 3.5% in the QTR on QTR.

Sydney’s property prices have seen a slight increase of 0.08% over the last week and have gone up by 1.8% in the past 28 days. However, they are still -5.1% lower than they were 12 months ago. Similarly, Melbourne’s property prices have risen 0.06% over the last week and 0.7% in the past 28 days, but they are still -5.7% lower than last year.

Brisbane’s property prices have risen 0.04% since the last week and 1.4% over the past 28 days, but they are still -7.6% lower than they were 12 months ago. Overall, Australian capital dwelling prices have risen by 1.3% in the past 28 days but have dropped by -4.7% over the last 12 months.

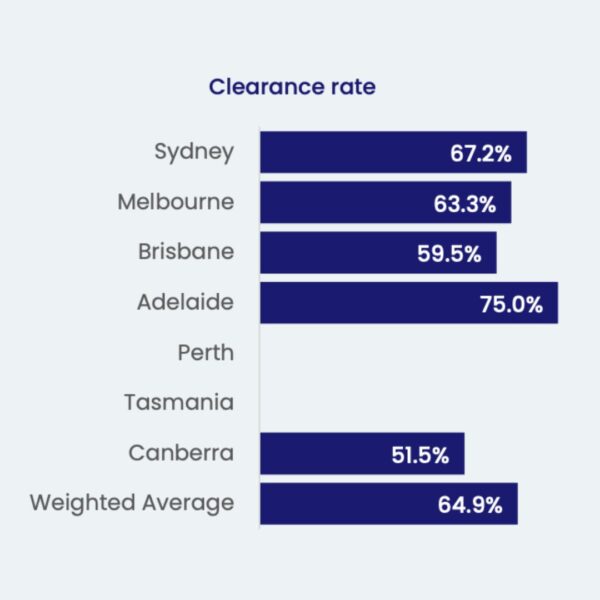

While the housing market is still going strong, it’s worth noting that there were fewer properties available in recent auctions, leading to an increase in the clearance auction rate. In fact, the demand for properties is exceeding the supply, which is why the auction clearance rate has been on an upward trajectory since last quarter. Thanks to this current market condition, there’s been a rise in the proportion of properties sold before auction day to the highest point since November 2021. This suggests that sellers are more inclined to accept offers before auction day because of the robust offers from buyers.

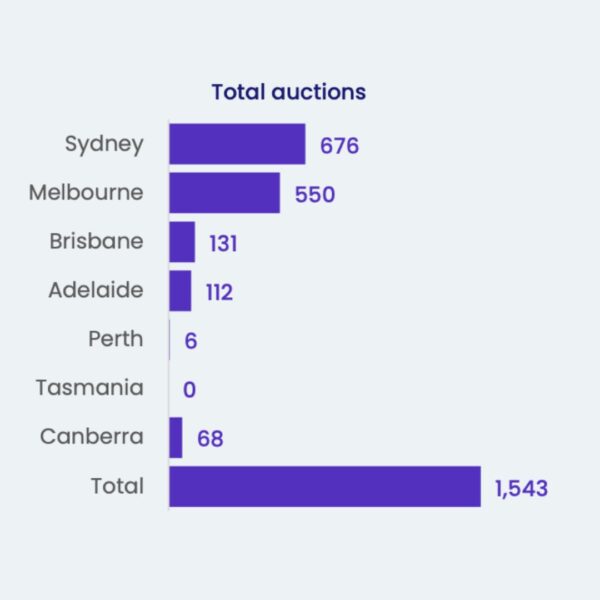

Last week, there were 1,543 auctions across the combined capitals compared to 1,791 the previous week, down -13.8% from last week and -18% lower than the 1,881 held this week last year.

Sydney was the busiest market, with 676 homes going up for auction. The preliminary clearance rate this week was clearance rate of 67.2% last week, the lowest clearance rate in the past 10 weeks. The previous week’s clearance rate was 2.8 percentage points higher at 70.0%, while this time last year Sydney recorded its lowest clearance rate of 2022, with only 49.9% of auctions across Sydney reporting a successful result.

Read the complete core logic report here.

In conclusion, the housing market is definitely going strong despite all the economic uncertainty. As always, demand is driving prices up, and buyers are willing to go to greater lengths to snag their ideal property. It’ll be interesting to see how the rest of the year pans out, but for now, it’s clear that the property market is holding its own.